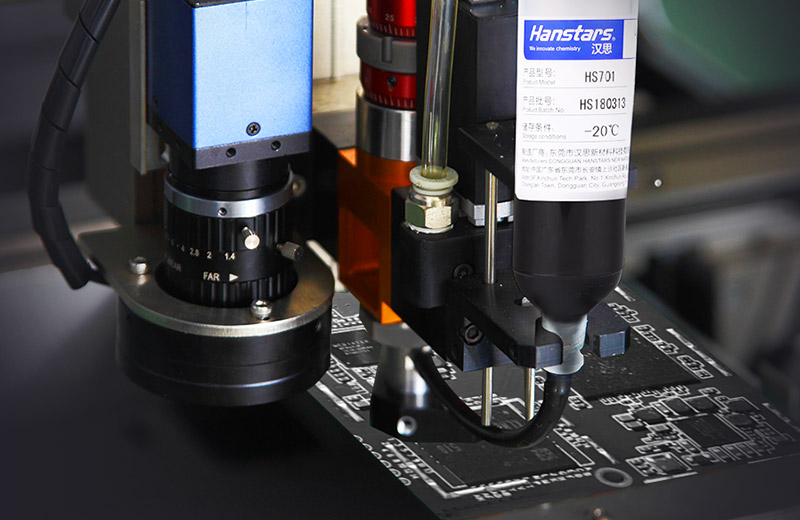

永利欢乐娱人城化学,深入消费类电子、医疗设备、航空永利欢乐娱人城、光电能源、汽车配件、半导体芯片等领域的胶水研发应用,由研发团队为客户量身定制胶水产品,助力客户降低成本,提升工艺品质,胶水产品快速交付,并确保其环保性和性能。

了解更多 +保证样品到量产的一致

环保性高于行业标准

研发团队跟踪式服务

Hanstars永利欢乐娱人城是面向全球化战略服务的一家创新型化学新材料科技公司,现成永利欢乐娱人城永利欢乐娱人城集团公司。

已设立东莞总部、中国香港、中国台湾、新加坡、马来西亚、印尼、泰国、印度、韩国、以色列、美国加州等各分支机构办事处。

了解更多 +总部东莞 中国香港 中国台湾

新加坡 马来西亚 印度尼西亚 泰国 印度 韩国

澳大利亚 以色列 美国加州

请填写您的需求,我们将尽快联系您